When btc dominance decreases, alts on the whole, gain value against btc. As the btc dom chart shows, an identical consolidation pahse took place from july to november 2017. 22.09.2021 · the bitcoin dominance judging by the current market cycle (2021), the dominance of bitcoin started to decline from april 2021 as many investors were looking for new altcoin investments. Vor 2 tagen · merten, who predicts an extended market cycle that lasts late into 2022, says that he sees a scenario where the crypto bull run finishes off with altcoin dominance springing up to new highs. In simple terms, when btc dominance is going down, we can assume that investors are converting their bitcoins for altcoins.

He says that the sheer size of bitcoin requires significantly more monetary energy to move the price of …

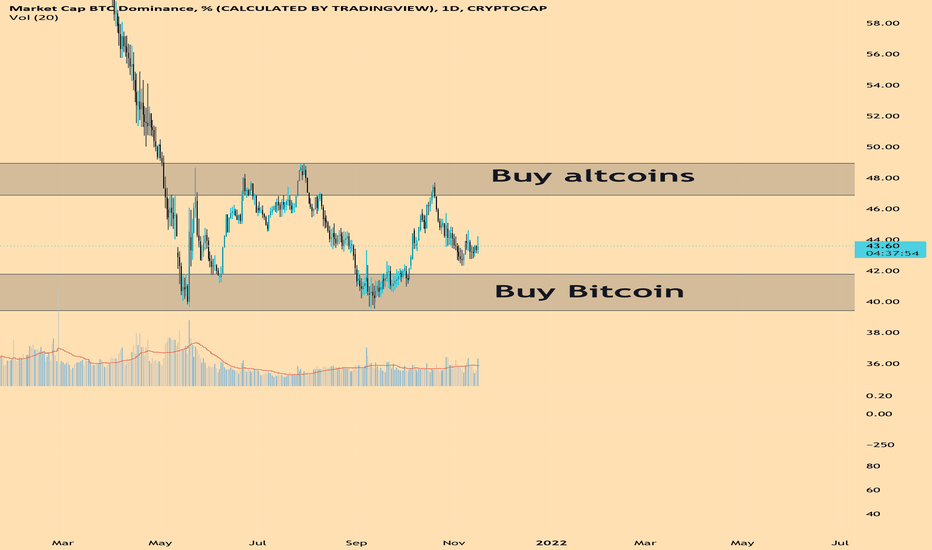

This sequence is very similar to the previous btc cycle, in fact its parabolic phase. The pseudonymous crypto analyst known as capo tells his 180,000 twitter followers that bitcoin dominance, which is bitcoin's market cap compared to the rest of the crypto market, looks to be trending higher, but will likely hit a hard resistance at the 50.00 level. In simple terms, when btc dominance is going down, we can assume that investors are converting their bitcoins for altcoins. The dominance of bitcoin is not rising alongside its value and currently stands … Vor 2 tagen · merten, who predicts an extended market cycle that lasts late into 2022, says that he sees a scenario where the crypto bull run finishes off with altcoin dominance springing up to new highs. Bitcoin dominance is a measure of how much of the total market cap of crypto is comprised of bitcoin. This surge of altcoin buying is sometimes an indicator that a market is overbought as investors seek new opportunities, and so potentially indicates the next stage of the ongoing market cycle. He says that the sheer size of bitcoin requires significantly more monetary energy to move the price of … Then following a golden cross, the price peaked and dived aggressively as btc. 22.09.2021 · the bitcoin dominance judging by the current market cycle (2021), the dominance of bitcoin started to decline from april 2021 as many investors were looking for new altcoin investments. There are many reasons why bitcoin might over or underperform its previous 1458 day behavior. How to interpret cycle repeat. It is not a …

The pseudonymous crypto analyst known as capo tells his 180,000 twitter followers that bitcoin dominance, which is bitcoin's market cap compared to the rest of the crypto market, looks to be trending higher, but will likely hit a hard resistance at the 50.00 level. In simple terms, when btc dominance is going down, we can assume that investors are converting their bitcoins for altcoins. The entire chart's accuracy depends on bitcoin's behavior to repeat itself perfectly. The future 1.458 day projections should be taken only as estimates. 19.11.2020 · bitcoin dominance is the percentage that measures bitcoin's share of the whole cryptocurrency market capitalization measured in percentages.

As the btc dom chart shows, an identical consolidation pahse took place from july to november 2017.

In simple terms, when btc dominance is going down, we can assume that investors are converting their bitcoins for altcoins. He says that the sheer size of bitcoin requires significantly more monetary energy to move the price of … This sequence is very similar to the previous btc cycle, in fact its parabolic phase. There are many reasons why bitcoin might over or underperform its previous 1458 day behavior. When btc dominance decreases, alts on the whole, gain value against btc. As the btc dom chart shows, an identical consolidation pahse took place from july to november 2017. Bitcoin dominance is a measure of how much of the total market cap of crypto is comprised of bitcoin. Then following a golden cross, the price peaked and dived aggressively as btc. The dominance of bitcoin is not rising alongside its value and currently stands … 19.11.2020 · bitcoin dominance is the percentage that measures bitcoin's share of the whole cryptocurrency market capitalization measured in percentages. The future 1.458 day projections should be taken only as estimates. It is not a … 22.09.2021 · the bitcoin dominance judging by the current market cycle (2021), the dominance of bitcoin started to decline from april 2021 as many investors were looking for new altcoin investments.

The future 1.458 day projections should be taken only as estimates. How to interpret cycle repeat. Bitcoin dominance is a measure of how much of the total market cap of crypto is comprised of bitcoin. There are many reasons why bitcoin might over or underperform its previous 1458 day behavior. When btc.d is going …

There are many reasons why bitcoin might over or underperform its previous 1458 day behavior.

The dominance of bitcoin is not rising alongside its value and currently stands … Then following a golden cross, the price peaked and dived aggressively as btc. Vor 2 tagen · merten, who predicts an extended market cycle that lasts late into 2022, says that he sees a scenario where the crypto bull run finishes off with altcoin dominance springing up to new highs. When btc dominance increases, alts, on the whole, lose value against btc. This surge of altcoin buying is sometimes an indicator that a market is overbought as investors seek new opportunities, and so potentially indicates the next stage of the ongoing market cycle. Bitcoin dominance is a measure of how much of the total market cap of crypto is comprised of bitcoin. 22.09.2021 · the bitcoin dominance judging by the current market cycle (2021), the dominance of bitcoin started to decline from april 2021 as many investors were looking for new altcoin investments. How to interpret cycle repeat. He says that the sheer size of bitcoin requires significantly more monetary energy to move the price of … There are many reasons why bitcoin might over or underperform its previous 1458 day behavior. The pseudonymous crypto analyst known as capo tells his 180,000 twitter followers that bitcoin dominance, which is bitcoin's market cap compared to the rest of the crypto market, looks to be trending higher, but will likely hit a hard resistance at the 50.00 level. 19.11.2020 · bitcoin dominance is the percentage that measures bitcoin's share of the whole cryptocurrency market capitalization measured in percentages. The future 1.458 day projections should be taken only as estimates.

Bitcoin Dominance Cycle / Uyl 5p1d92fo9m / There are many reasons why bitcoin might over or underperform its previous 1458 day behavior.. The entire chart's accuracy depends on bitcoin's behavior to repeat itself perfectly. When btc.d is going … When btc dominance increases, alts, on the whole, lose value against btc. This surge of altcoin buying is sometimes an indicator that a market is overbought as investors seek new opportunities, and so potentially indicates the next stage of the ongoing market cycle. The pseudonymous crypto analyst known as capo tells his 180,000 twitter followers that bitcoin dominance, which is bitcoin's market cap compared to the rest of the crypto market, looks to be trending higher, but will likely hit a hard resistance at the 50.00 level.